Ruapehu property owners will soon receive new three-yearly rating valuations in the post.

Updated values have been prepared for all 10,141 properties in the district by independent valuers Quotable Value (QV) on behalf of Ruapehu District Council. They reflect the likely price a property would have sold for on 1 July 2023, not including chattels.

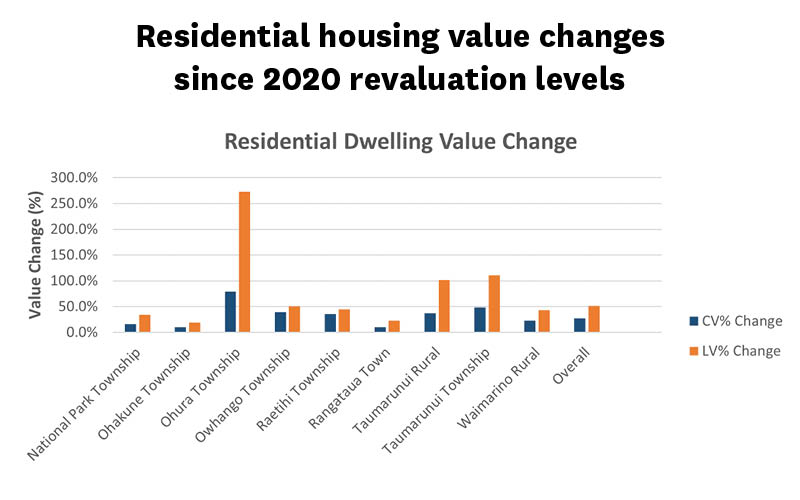

Since the district’s last revaluation in 2020, the value of residential housing has increased by an average of 28%. The average house value is now at $361,000, while the corresponding average land value has increased by 51% to a new average of $132,000.

QV Manawatu/Taranaki manager Simon Willocks said it had been a “rollercoaster” last three years for the property market, with record-low interest rates helping to drive significant value growth in 2021, before experiencing a long period of decline throughout 2022 and 2023.

“We’ve witnessed a strong increase in residential property value levels overall since our last revaluation in Ruapehu in 2020. Though property values have softened over the past 18 months or so, they’re not yet back to their pre-pandemic levels and appear to be levelling out now,” he said.

The average capital value of an improved lifestyle property has increased by 22% to $577,000, while the corresponding land value for a lifestyle property increased by 27% to $235,000. “Ruapehu lifestyle market has seen strong growth since 2020, with its relatively low price point by national standards appealing to those wishing to begin lifestyle living or looking to retire in the area,” Mr Willocks added.

Meanwhile, commercial property values have increased by 1.8% and property values in the industrial sector have increased by 24% since the district’s last rating valuation in 2020. Commercial and industrial land values have also increased by 20% and 42% respectively.

Pastoral farms dominate the local rural sector, with a 28% average increase in capital values and an average land value increase of 30%.

The total rateable value for the district is now $8.0 billion, with the land value of those properties now valued at $4.6 billion.

Rating valuations are usually carried out on all New Zealand properties every three years to help local councils assess rates for the following three-year period. They are not intended to be used for any other purpose, including raising finance with banks or as insurance valuations.

They reflect the likely selling price of a property at the effective revaluation date, which is 1 July 2023, and do not include chattels. Any changes in the market since that time will not be included in the new rating valuations, which often means that a sale price achieved today will be different to the new rating valuation.

Rating valuations are calculated using a highly complex and detailed process that utilises all relevant property sales from your area. A large number of properties will also be physically assessed, particularly those that have been issued building consents in the last three years.

The updated rating valuations are independently audited by the Office of the Valuer General to ensure they meet rigorous quality standards, before the new rating valuations are confirmed and posted to property owners.

If owners do not agree with their rating valuation, they have a right to object through the objection process before 19 January 2024.

Residential housing value changes since 2020 revaluation levels:

Click on QV banner below: